DESPITE THE Workers’ Compensation Insurance Rating Bureau recommending that benchmark rates in California be increased in the last two years, rates that insurance companies are charging continue falling.

The California Department of Insurance in fact rejected the Rating Bureau’s rate hike recommendations in both in 2021 and 2022 when it had asked for 2.7% and 7.6% increases respectively, and it instead ordered that benchmark rates remain unchanged.

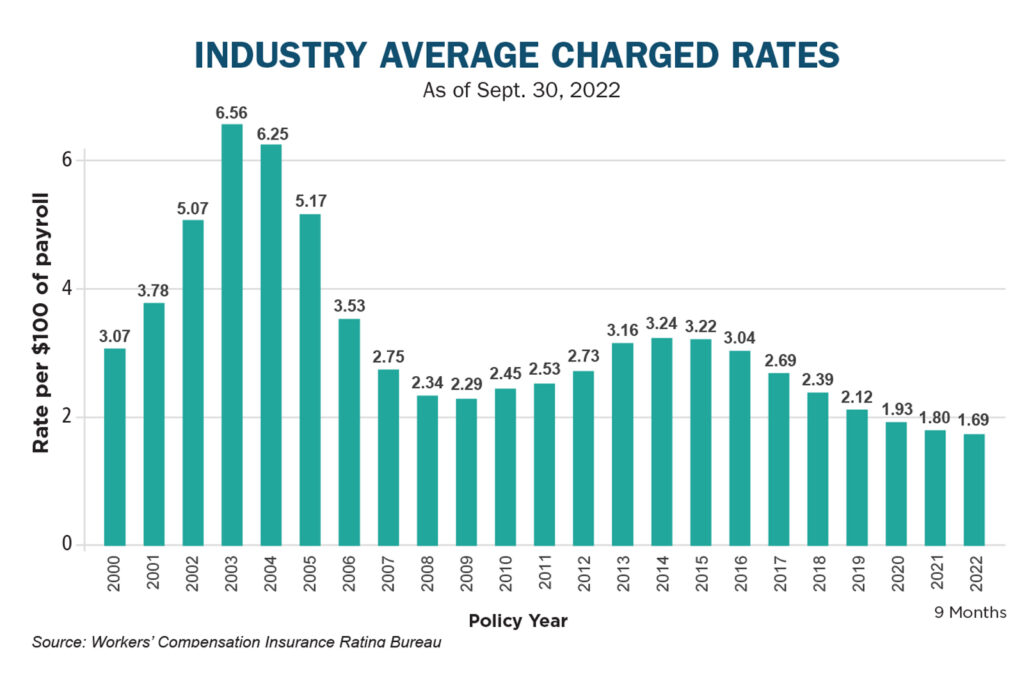

Despite that, average charged rates slipped 6.1% in the first nine months of 2022 from the end of 2021, according to a data from the

Workers’ Compensation Insurance Rating Bureau. Insurers are free to charge what they want regardless of the benchmark rates, which are set to help guide their price-setting.

A caveat: Rates will vary from employer to employer and those who have claims may see their rates increase instead of fall.

Competition has been fierce in the workers’ compensation insurance market and rates charged to employers have been falling since 2005, although there was a slight uptick in 2013 and 2014, followed by further declines.

Since 2005, there has been a series of legislative reforms that cut costs and increased benefits for injured workers, and resulted in more predictable and declining claims costs.

Average charged rates have fallen 48% since 2014 and 74% since 2003 (see chart).

What’s next?

There are signs that the tide may turn in the coming years, as insurance companies’ expense ratios continue creeping higher. A standard measure, the “combined ratio” measures claims costs, claims adjustment costs and other overhead in relation to the premium that insurers charge.

For 2021, the average combined ratio for workers’ comp carriers in California climbed to 113, meaning that for every dollar they take in in premium, they spend $1.12. That’s compared with a combined ratio of 104 in 2021 and 79 in 2016.

Typically, rate increases follow rising combined ratios and the Workers’ Comp Executive predicts that rates will start climbing.

FACTORS THAT COULD FEED RATE HIKES

- Higher medical costs for injured workers,

- Increasing frequency of workers’ comp claims,

- Increasing share of costly cumulative trauma claims,

- Inadequate rates, and

- Higher claims adjusting expenses.